Director Fee Subject To Pcb

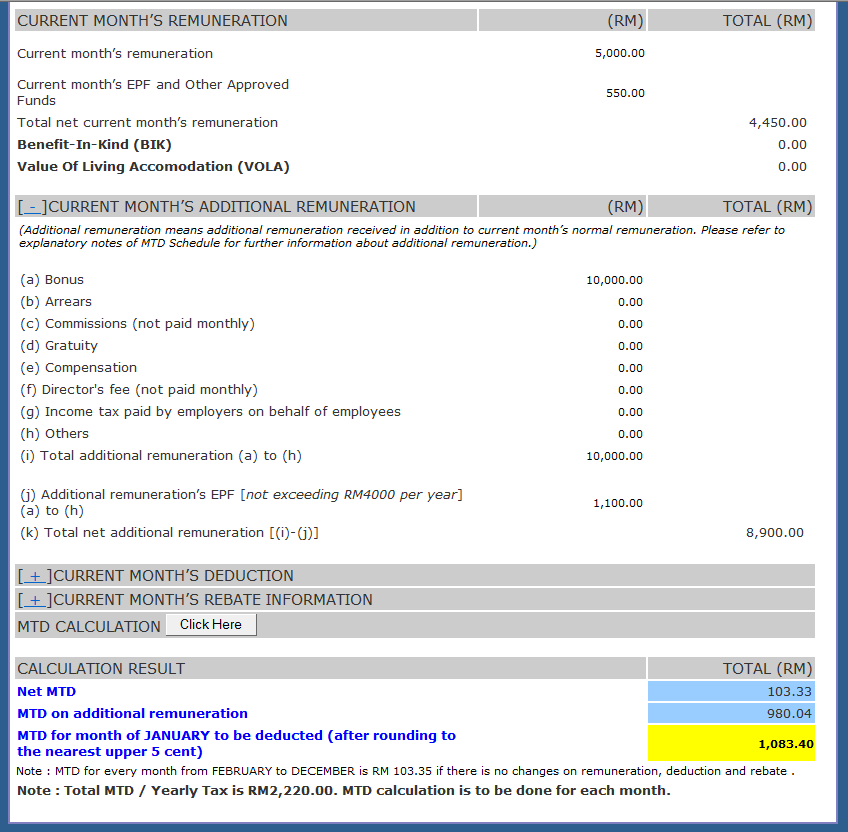

Mtd computation for bonus and director s remuneration.

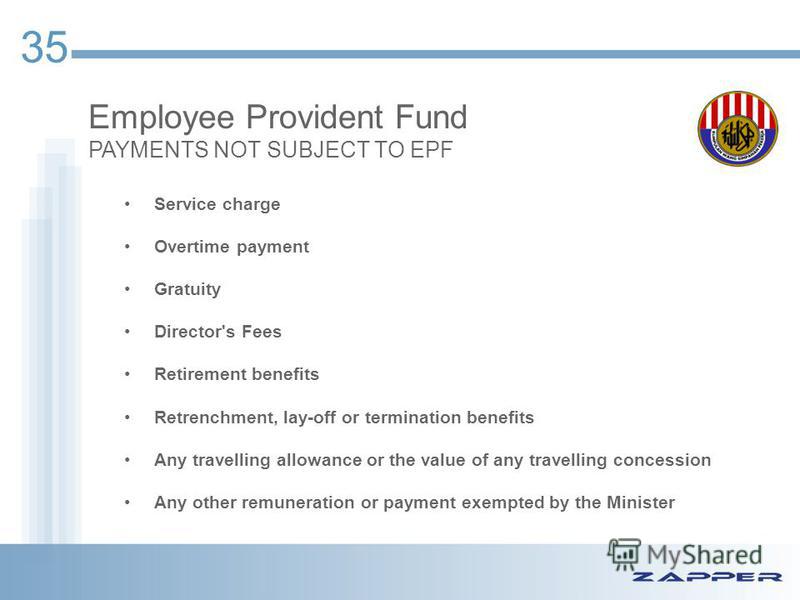

Director fee subject to pcb. Nomadic aborigines unless recommended in certain cases by the director general of the department of aborigines. In 2009 malaysia s income tax moved to a monthly tax deduction mtd or potongan jadual bercukai pcb. Employers are legally required to contribute epf for all payments of wages paid to the employees. Please refer to the ministry of manpower website for more information on a contract of service.

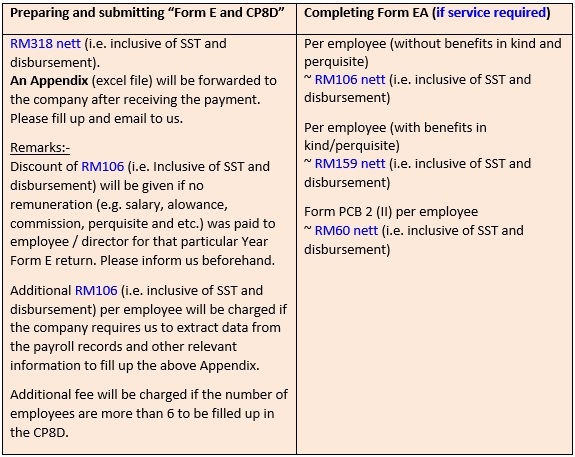

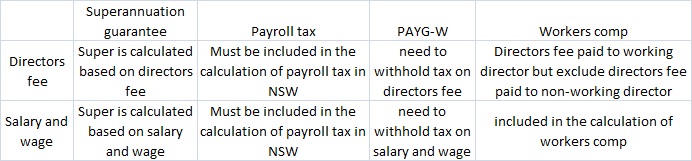

The type of remuneration received will affect the need for disclosure of the remuneration the making of cpf contributions and also whether such payment will be subject to tax. We have steady monthly 5 figure business profit. Find your pcb amount in this income tax pcb 2009 chart. Director s fees are fees to be paid to a director in their capacity as company director for the directorial services they perform for the company.

Director s fees approved in arrears the company voted and approved director s fee of 20 000 on 30 jun 2019 to be paid to you for your service rendered for the accounting year ended 31 dec 2018. Income tax pcb calculation. My monthly pcb income tax is increased much since march 2009 hr told me that malaysia monthly income tax pcb deduction rate is changed since year 2009. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time.

Person not obligated to contribute. I 39 ve run a sdn bhd company since last year. Cpf contributions are not payable on directors fees voted to them at general meetings. We 39 ve 0 employee as me and partner running the business by own.

Calculate your taxable salary taxable salary gross salary epf. Remuneration or fee paid to the director. We are in equal share stake 50 50. Directors of a company are considered employees if they are engaged under a contract of service and paid a salary on top of any directors fees received.

Scenario for bonus and director s fee payment and how to compute the mtd for year 2009 onward. We 39 re thinking of payout director fees monthly rm5k for each person as it can be. Hence the earliest date on which the director is entitled to the director s fees is the date the fees are voted and approved at the company s agm. Persons stipulated in the first schedule of the epf act 1991 who are exempted from making a contribution are as follows.

Now we are planning to have payout from company as we didn 39 t draw a single cent since beginning.