For Bank Use Only Meaning

With every transaction banks create an electronic record.

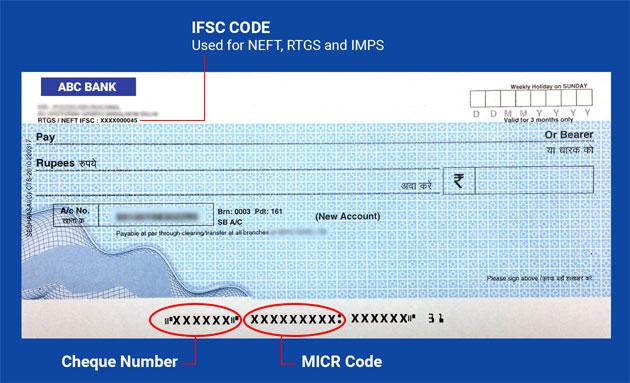

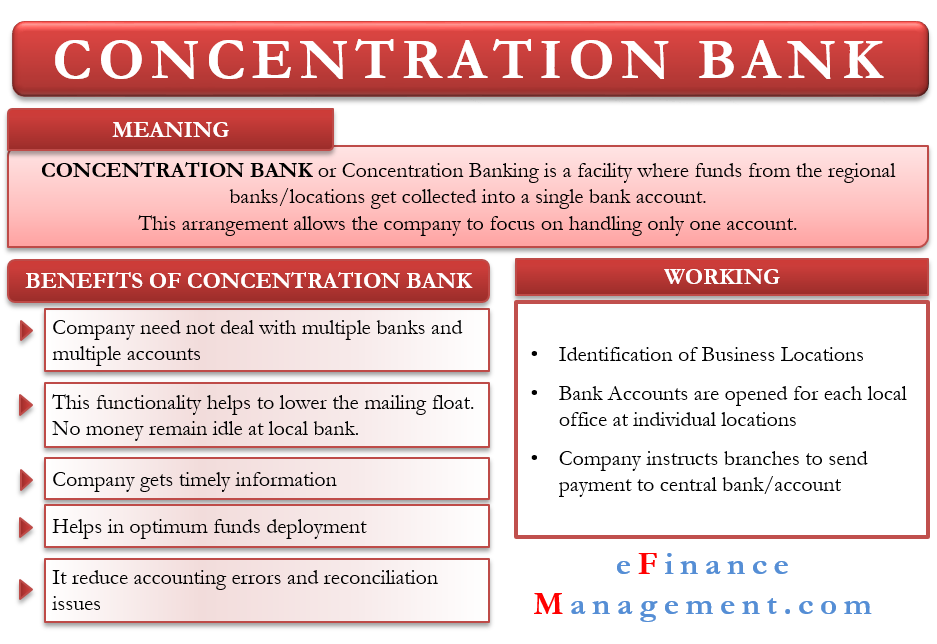

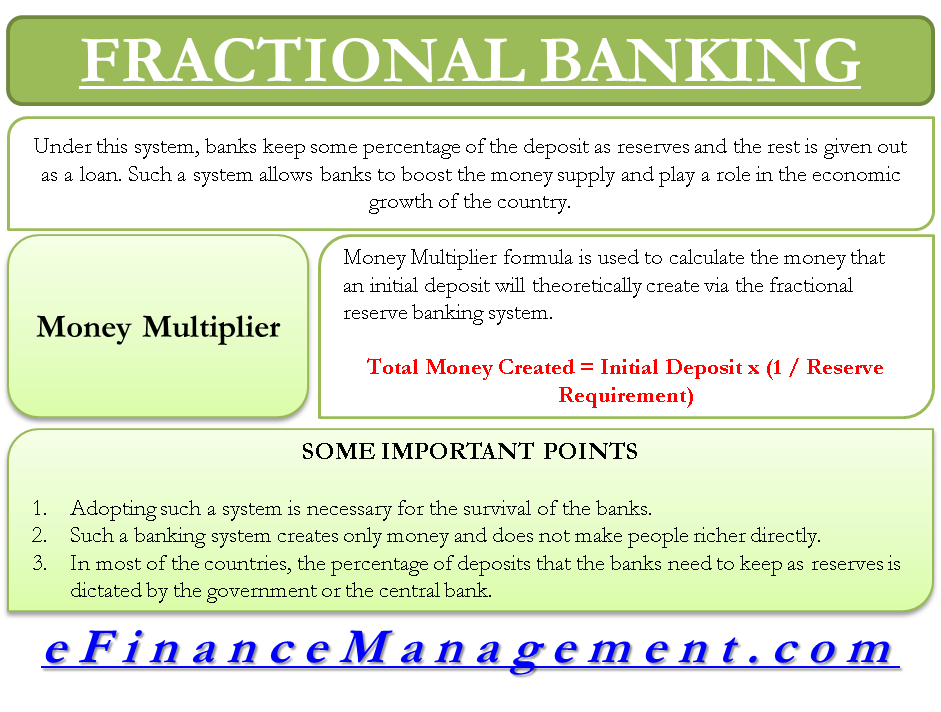

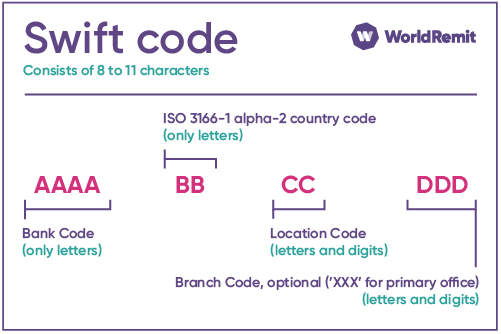

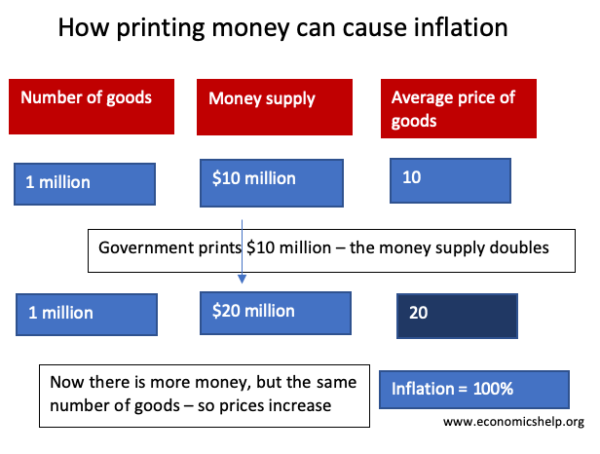

For bank use only meaning. Bank reconciliations are completed at regular intervals to ensure that. Bank deposits refer to this liability rather than to the actual funds that have been deposited. It says who and where they are a sort of international bank code or id. Domestic bank to bank transfers are conducted through the fedwire system which uses the federal reserve system and its assignment of aba routing transit number which uniquely identify each bank.

Reconciling the two accounts helps determine if accounting adjustments are needed. Banks in the united states use swift to send messages to notify banks in other countries that a payment has been made. It s used to identify banks and financial institutions globally. If you write for deposit only on the back of a check made out to you and then sign your name the check can only be deposited in your account.

The deposit itself is a liability owed by the bank to the depositor. A bank reconciliation is a document that matches the cash balance on the company s books to the corresponding amount on its bank statement. Use only where there are multiple account relationships in the currency of the transaction between the sender and the receiver and one of these accounts is to be used for reimbursement. Each adr represents a specific number of adss based on the bank s agreement with the issuing corporation.

A us bank that holds american depositary shares adss or shares of corporations based outside the united states and sells american depositary receipts adrs to us investors is called a depositary bank. Use option a 53b sender s correspondent definition. A bank is a financial institution licensed as a receiver of deposits and can also provide other financial services such as wealth management. There s no need for paper ink fuel to transport checks time and labor to handle and deposit checks and so on.

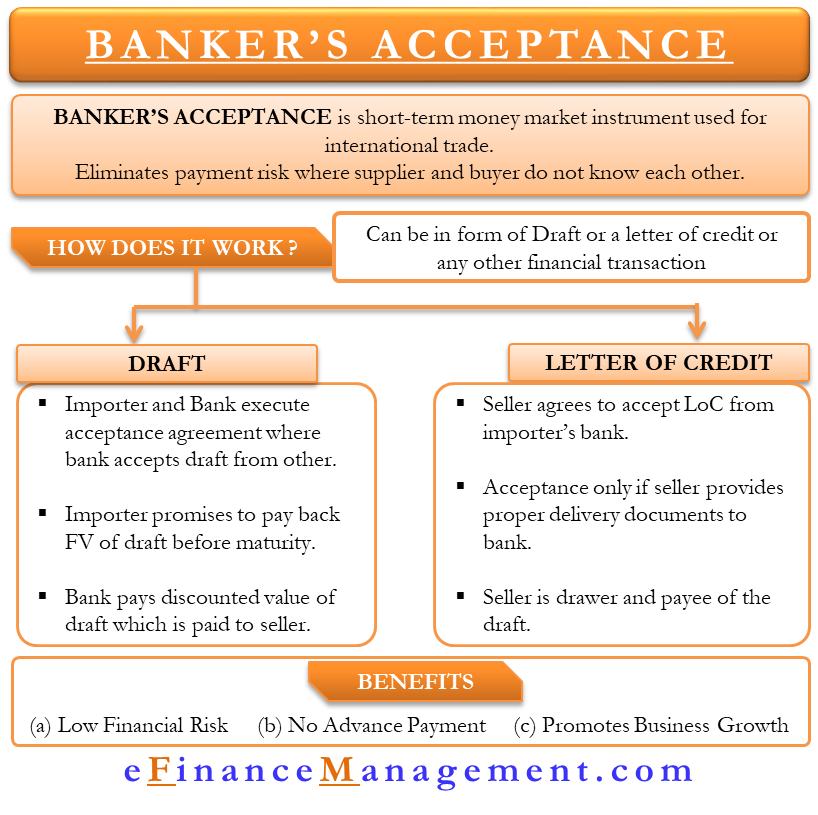

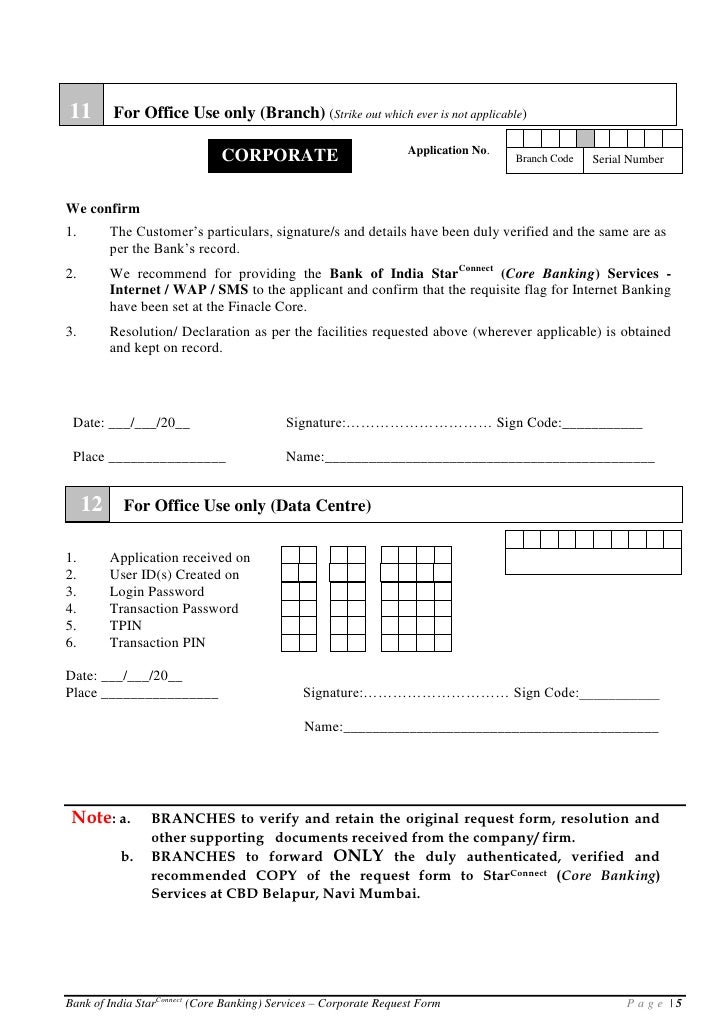

If received from the financial institution or branch initiating the transfer. These codes are used when transferring money between banks in particular for international wire transfers or sepa payments. Banks use the chips or fedwire system to actually effect the payment. Banks also use these codes to exchange messages between each other.

This is called a restrictive indorsement and it should prevent you or any other person from cashing the check. The online banking system will typically connect to or be part of the core banking system operated by a bank and is in contrast to branch banking. Because they re electronic ach payments use fewer resources than traditional paper checks.

/endorse-checks-payable-to-multiple-people-315299-v2-5bbdffc846e0fb0026eccaf4.png)

/back-of-a-check-315354-v3-5b8814724cedfd002522df54.png)

:max_bytes(150000):strip_icc()/GettyImages-949219696-e4c7b0e0b92847cb91ac7cc928362bad.jpg)

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

/bank-wire-transfer-basics-315444_v3-5c89408ec9e77c0001a3e605.png)