Hire Purchase Double Entry Singapore

Journal entries in the books of purchaser a for buying assets on hire purchase asset on hire purchase account dr.

Hire purchase double entry singapore. These expenses are not deductible even if the private cars were used for business purposes. Debit cost of office equipment 15 000 debit gst input. The second entry would reduce the interest portion from the suspense account. Such transfer assignment of the title to goods is not treated as a.

When i am purchased the car debit car 70 000 credit. Read on for more information. Private hire cars private car expenses. The double entry will be.

Obviously the 33 33 interest expense is a debit and to complete the double entry for that a credit must be made against something. Credit hire purchase 19 200. Our stakeholders include government and industry bodies employers educators and the public. The double entry will be.

Expenses incurred directly or in the form of reimbursement on using private hire cars or private cars e q or s plate cars such as repair maintenance parking fees petrol costs are disallowable. Testimonials from our valued customers. When the hire purchase has been approved transfer from account payable to hire purchase creditor. Hire purchase transactions require the.

Towards singapore s transformation into a global accountancy hub. Hire purchase agreements if any monthly cpf statements if any monthly foreign worker levy statements if any used cheque book stubs if any salary vouchers if any any document that could possibly explain a particular accounting entry. Isca is the administrator of the singapore qualification programme singapore qp and the designated entity to confer the chartered accountant of singapore ca singapore designation. When transactions or event happen we record them.

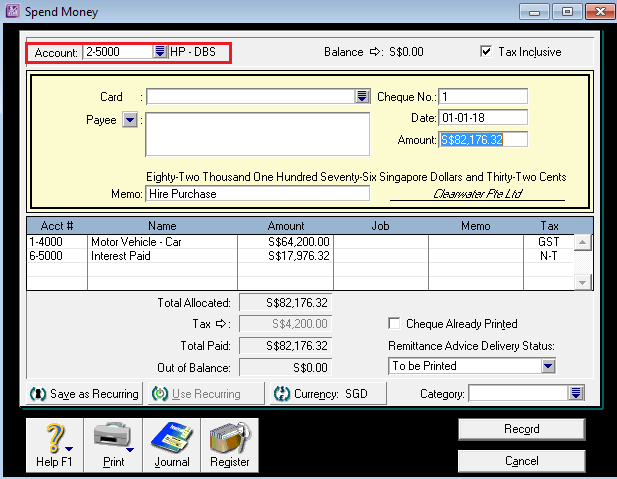

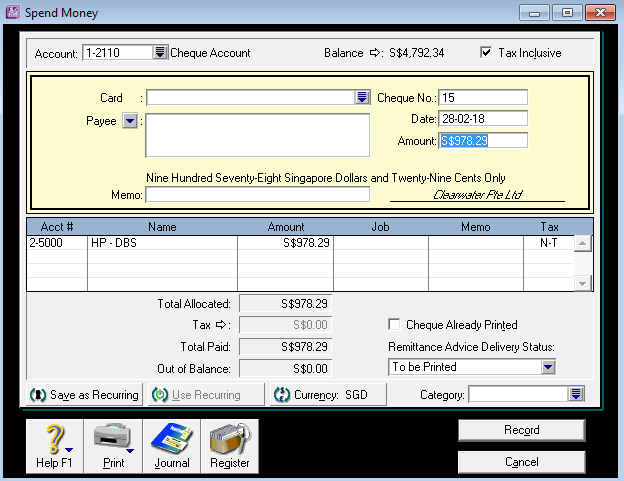

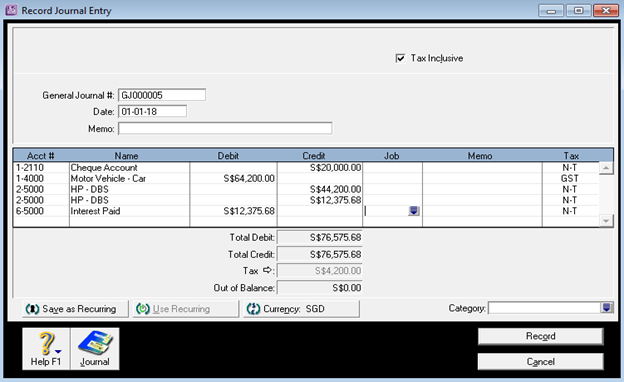

Next pass a journal to transfer the amount from contra bank account to your hire purchase creditor account. Debit interest suspense balance sheet current liability type. Debit contra bank account balance sheet bank account type. There are four methods of accounting for hire purchase.

Cash price method under cash price method we are deal hire purchase transactions just like normal transactions. The financier would also transfer assign the title to goods when he assigns the hire purchase agreement to the new financier. When i pay the down payment debit account payable 20 000 credit bank 20 000. You create both the interest in suspense and hire purchase account as a long term liability since the payment term is more than a year.

Transfer to hire purchase creditor account. Hire purchase hp or leasing is a type of asset finance that allow firms or individuals to possess and control an asset during an agreed term while paying rent or instalments covering depreciation of the asset and interest to cover capital cost. The double entry of the enter bill transaction.